When entrepreneurs embark on their business journey, forming a partnership firm often serves as a straightforward initial step. However, as businesses expand, partners may contemplate transitioning into a company. This transformation, while seeming daunting, offers significant advantages and necessitates understanding legal requirements. In this guide, we delve into the process of converting a partnership firm into a company.

Understanding the Basics

Before delving into the conversion process, grasping the distinction between a partnership firm and a company is crucial. A partnership firm involves ownership and operation by multiple partners, each bearing full liability for the firm’s debts under the Indian Partnership Act of 1932. Conversely, a company, governed by the Companies Act of 2013, operates as a separate legal entity, managed by a board of directors and owned by shareholders.

In a partnership firm, profits and losses are shared among partners, with individual taxation applied to their income. Conversely, companies face corporate tax rates on profits, with shareholders receiving dividends based on their holdings.

Advantages of Conversion

Converting a partnership firm into a company yields several benefits. Firstly, a company’s separate legal identity enables it to enter contracts, own assets, and litigate independently, shielding shareholders from personal liability. Moreover, a company’s perpetual succession ensures business continuity despite changes in directors or shareholders.

Additionally, companies enjoy enhanced access to funding sources such as bank loans and equity funding, facilitating expansion and investment opportunities.

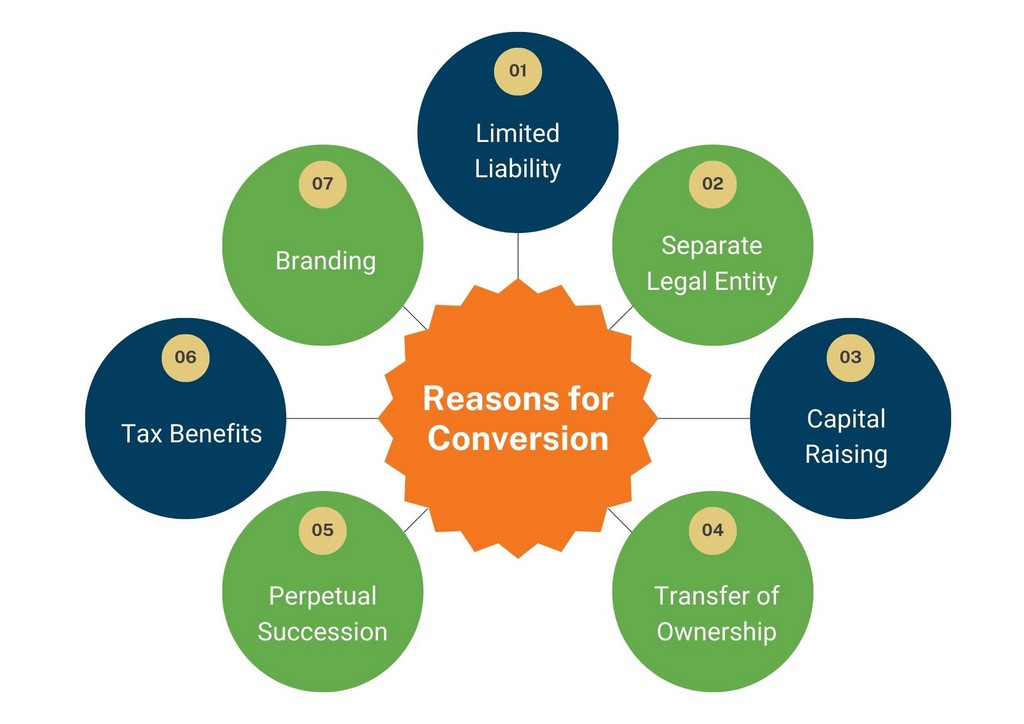

Reasons for Conversion

Partners might consider converting their firm into a company for reasons including:

Conversion Procedure

The conversion process involves several steps:

- Obtain DSC and DIN: Partners must secure Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) for designated directors.

- Name Approval: Apply for a unique company name compliant with Companies Act 2013 guidelines.

- Draft MOA and AOA: Prepare Memorandum of Association (MOA) and Articles of Association (AOA) outlining company objectives and rules.

- File Forms with ROC: Submit incorporation documents and requisite forms to the Registrar of Companies (ROC).

- Obtain Certificate of Incorporation: Upon approval, receive the Certificate of Incorporation from the ROC.

- Obtain PAN and TAN: Apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for tax compliance.

- Transfer Assets and Liabilities: Shift partnership firm assets and liabilities to the newly formed company.

Tax Implications

Conversion entails tax implications, including potential capital gains tax on asset transfers. Companies must adhere to corporate tax laws and maintain accurate financial records to ensure compliance. Consulting tax professionals and accountants is advisable to navigate tax implications effectively.

In conclusion, converting a partnership firm into a company offers manifold benefits but requires meticulous planning and adherence to legal and tax regulations. For more insights and professional assistance, visit www.cajdshah.com. At J. D. Shah Associates, we are committed to guiding businesses through every stage of their transformation journey, ensuring compliance and maximizing potential.

![]()