Raising capital through an Initial Public Offering (IPO) is a crucial step for companies looking to expand their operations and achieve long-term growth. IPO listing involves making a company’s shares available to the public on stock exchanges such as NSE and BSE in India. Small and medium-sized enterprises (SMEs) also have the opportunity to list on platforms like NSE Emerge and BSE SME. However, the IPO process is complex and requires strict adherence to SEBI’s ICDR regulations.

IPO Advisors play a pivotal role in this journey, guiding companies through the entire listing process while ensuring compliance and maximizing valuation. This article explores the critical role of IPO Advisors in the IPO listing and pre-IPO process, highlighting their impact on tax audit, income tax declaration, and auditing and taxation compliance.

Who Are IPO Advisors?

IPO Advisors are experienced professionals who help businesses navigate the complexities of going public. They provide end-to-end guidance, ensuring that promoters focus on their business while experts handle IPO-related procedures. Their responsibilities include selecting the right merchant banker, overseeing due diligence, managing pre-IPO funding, and handling documentation and compliance.

The Role of IPO Advisors in IPO Listing and Pre-IPO Process

1. Strategic Planning and IPO Structuring

IPO Advisors assist companies in structuring their IPO by determining the number of shares to issue, setting a fair IPO valuation, and deciding the right timing for the public offering. They collaborate with merchant bankers and lead managers to optimize the company’s financial strategy.

2. Regulatory Compliance and Legal Assistance

Navigating regulatory frameworks is a significant challenge in the IPO process. IPO Advisors ensure compliance with SEBI regulations, stock exchange norms, and other statutory requirements. They assist in preparing key documents, such as the Draft Red Herring Prospectus (DRHP), ensuring transparency and accuracy.

3. Due Diligence and Financial Preparation

Before an IPO, a company must undergo a comprehensive financial review, including tax audits and income tax declaration checks. IPO Advisors facilitate financial due diligence, ensuring that financial statements comply with auditing and taxation standards. This builds investor confidence and reduces potential risks.

4. Preparing the IPO Prospectus and Key Documents

One of the most critical steps in the IPO process is drafting the DRHP, which contains vital company information for investors. IPO Advisors work closely with legal and financial teams to ensure that the prospectus accurately represents the company’s business model, financial performance, and risk factors.

5. IPO Valuation and Pricing

Determining the right IPO pricing is essential for attracting investors and raising adequate capital. IPO Advisors analyze market trends, investor sentiment, and financial metrics to assist companies in setting fair valuations. They work with book-running lead managers to optimize IPO pricing strategies.

6. Marketing and Investor Relations

IPO Advisors help companies promote their IPO through roadshows, investor meetings, and strategic marketing initiatives. They ensure that institutional and retail investors have access to relevant company information, helping to generate demand for the public offering.

7. Post-IPO Compliance and Support

Even after a successful IPO, companies must maintain regulatory compliance and investor relations. IPO Advisors assist in managing post-issue obligations, including financial reporting, shareholder communication, and regulatory filings.

This is the format for Restated financials statements to be used for SME IPO. Free tool for companies going for SME ipo for marketing.

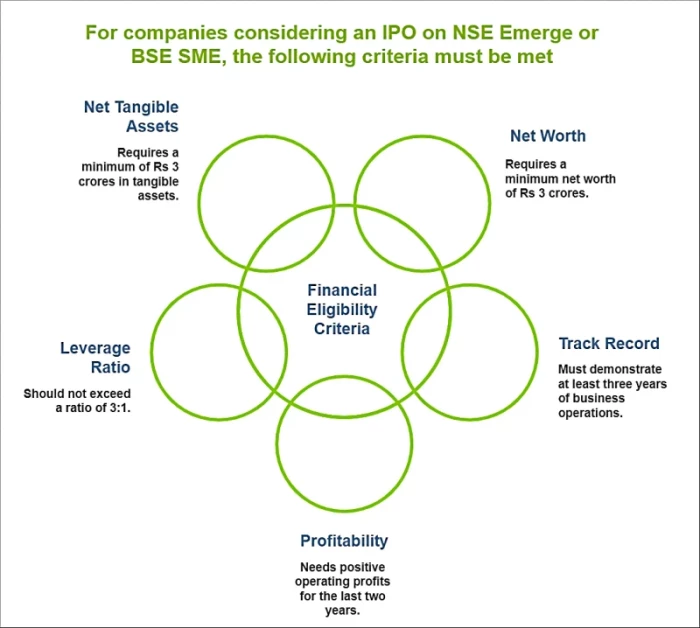

Eligibility Criteria for Listing on SME Platforms

When is the Right Time to Launch an IPO?

Once a company meets the IPO eligibility criteria, the process typically takes 5 to 7 months. IPO Advisors assist in securing approvals, finalizing documentation, and coordinating with merchant bankers to ensure a timely listing.

Why Choose JD Shah Associates for IPO Advisory?

JD Shah Associates is a leading IPO Advisory firm specializing in tax audit, income tax declaration, and auditing and taxation compliance. With years of experience in the financial and regulatory landscape, JD Shah Associates provides expert guidance to companies looking to go public.

Our expertise in IPO valuation, strategic planning, regulatory compliance, and investor relations ensures a seamless IPO process, maximizing value for businesses and their stakeholders.

Conclusion

IPO Advisors play a vital role in ensuring the success of an IPO by guiding companies through strategic planning, compliance, financial preparation, valuation, marketing, and post-IPO support. Their expertise in tax audits, income tax declarations, and auditing and taxation helps businesses navigate the complexities of the public listing process.

By partnering with an experienced IPO Advisory firm like JD Shah Associates, companies can enhance their IPO readiness, secure regulatory approvals, and optimize their market position. Whether you are an SME or a larger enterprise, expert IPO guidance is key to a successful and compliant public offering.

![]()