Non-Resident Indians (NRIs) often encounter challenges when dealing with Indian income tax laws. This guide on Income Tax for NRIs simplifies your tax filing obligations and highlights key considerations for compliance. Understanding NRI income tax rules can save you from penalties and ensure seamless financial planning.

Obligations of NRIs for Income Tax Filing

Who Must File Income Tax in India?

NRIs are required to file income tax returns in India if :

1. Income in India Exceeds the Exemption Limit

- ₹2,50,000 for individuals below 60 years.

- ₹5,00,000 for senior citizens (depending on age).

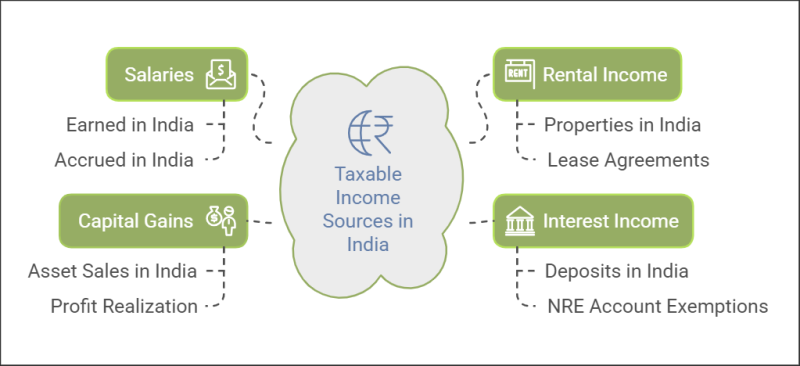

2. Taxable Income Sources

3. Threshold for Tax Deduction at Source (TDS)

- Even with TDS deductions, filing is mandatory if income crosses the minimum threshold.

Tax Filing Process for NRIs

1. Determine Residential Status

- Confirm NRI status (stay in India for less than 182 days in a financial year qualifies).

2. Documents Required

- PAN card.

- TDS certificates (Form 16A/16B).

- Income proofs and bank statements.

3. Choose the Right ITR Form

- Use NRI ITR-2 for income from capital gains or foreign assets.

4. Pay Taxes and Claim Deductions

- Report all income accurately.

- Claim deductions like Section 80C (investments) and Section 80D (insurance premiums).

5. File Online

- Use the Income Tax e-Filing Portal for seamless ITR filing for NRIs in India.

Consequences of Non-Filing

Failing to comply with NRI taxation rules can lead to serious repercussions:

1. Financial Penalties

- Late filing fee under Section 234F (up to ₹5,000).

- Additional interest under Sections 234A, 234B, and 234C for delayed or insufficient tax payments.

2. Legal Prosecution

- Non-compliance may invoke prosecution under Section 276CC, with imprisonment ranging from 3 months to 7 years.

3. Denial of Refunds

- Excess TDS deductions cannot be claimed unless returns are filed.

4. Effect on Future Compliance

- Failing to comply may trigger scrutiny by the Income Tax Department, resulting in audits or inquiries into financial transactions.

5. Non-Declaration Higher Tax Rates

- Undisclosed income may attract taxation at the highest applicable rates.

Special Considerations for NRIs

1. Leverage Double Tax Avoidance Agreements (DTAA)

- Avoid paying taxes twice with DTAA provisions.

2. Understand Exemptions

- Interest on NRE accounts remains tax-exempt if NRI status is maintained.

3. Stay Updated on New Rules for NRIs in India

- Familiarize yourself with the latest income tax slabs for OCI in India and exemptions.

Compliance Tips for NRIs

1. Seek Professional Assistance

- Work with the Best Chartered Accountant for NRI Tax Return Filing in India for accurate compliance.

2. Maximize Deductions:

- Utilize all eligible deductions under Indian tax laws.

3. File Zero-Liability Returns

- Filing even when no tax is payable ensures smooth financial transactions.

Why JD Shah Associates is the Top Choice for NRI Taxation?

Filing income tax returns is more than a legal requirement; it serves as protection against penalties, legal action, and financial setbacks. With proper knowledge and timely compliance, NRIs can efficiently fulfill their tax obligations in India while minimizing risks. Leverage ICAI resources for the latest guidelines and expert support.

Take control of your tax responsibilities with expert guidance of Top CA in Mumbai. For hassle-free NRI Tax Consultancy in India and to ensure compliance with ease. Contact us today!

![]()