This guide presents a comprehensive technical overview of tax filing requirements for non-residents under the Indian Income Tax Act, 1961 and associated rules, circulars, and notifications issued by the Central Board of Direct Taxes (CBDT). Whether you’re an NRI investor, professional, or business owner, understanding the framework is crucial to staying compliant and making informed decisions.

- An individual is considered a non-resident if they do not satisfy either of these conditions:

- Present in India for 182 days or more during the relevant financial year (FY); or

- Present in India for 60 days or more during the relevant FY and 365 days or more during the four preceding FYs

- Special provisions apply to Indian citizens or Persons of Indian Origin visiting India (182-day rule only) and Indian citizens leaving India for employment or as crew members of Indian ships.

- The concept of “Not Ordinarily Resident” (NOR) applies as an intermediate category between resident and non-resident.

This residency test also influences whether or not a statutory audit is required for any income-generating activities within India.

Filing Requirements

Form Selection

Non-residents are required to file:

- ITR-2 (for individuals with no business/professional income)

- ITR-3 (for individuals with business/professional income)

- ITR-4 (for presumptive business income under sections 44AD, 44ADA, or 44AE)

- Form 10F (for claiming tax treaty benefits)

The Best CA firm in Borivali can help non-residents choose the appropriate return form based on their income profile and applicable sections of the Income Tax Act.

Filing Deadlines

- Standard filing deadline: July 31st following the relevant assessment year

- Extended deadline for transfer pricing cases: November 30th

- Belated returns: Can be filed with penalties before the end of the relevant assessment year

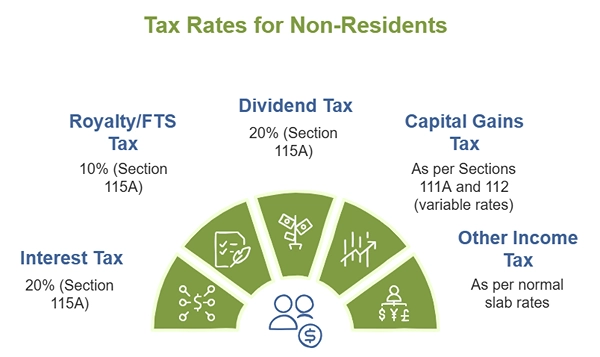

Income Classification and Taxation

Scope of Taxable Income

For non-residents, only Indian-sourced income is taxable, including:

- Income received or deemed to be received in India

- Income accruing or arising in India

- Income deemed to accrue or arise in India (Section 9)

A seasoned Tax Consultant can help classify the income types accurately, ensuring the correct treatment of each under Indian tax law.

Special Provisions Under Section 9

Income deemed to accrue or arise in India includes:

- Income from business connection in India

- Salaries for services rendered in India

- Dividend income from Indian companies

- Interest income from Indian sources

- Royalty and fees for technical services (FTS) from Indian residents

- Capital gains from transfer of assets situated in India

For clients who want accurate assessments and clear reports, firms offering Direct Tax Services are ideal partners.

Double Taxation Avoidance Agreements (DTAAs)

Treaty Benefits

India has DTAAs with over 90 countries that may provide:

- Reduced withholding tax rates

- Exemption for certain income types

- Tie-breaker rules for dual residency cases

- Methods for elimination of double taxation

Claiming Treaty Benefits

Requirements include:

- Tax Residency Certificate (TRC) from home country

- Form 10F (where TRC does not contain all required particulars)

- PAN (Permanent Account Number)

- Self-declaration regarding beneficial ownership

If you’re unsure about documentation, it’s best to Contact Chartered Accountant professionals to guide you in meeting treaty compliance requirements.

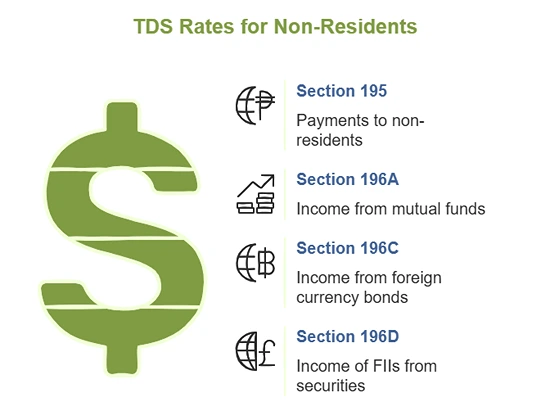

Tax Withholding Provisions

Lower TDS Certificate

Application under Section 197 allows a lower TDS deduction if granted by the Assessing Officer.

Leading firms offering Tax Consultancy Services in Mumbai can assist non-residents in filing Form 13 for obtaining such certificates from the Income Tax Department.

Special Provisions

Foreign Tax Credit (FTC)

Rule 128 enables taxpayers to claim credit of foreign taxes paid, provided proper documentation and disclosures are made.

Specified Financial Transactions

Under Section 285BA and Rule 114E, certain high-value or specified transactions must be reported.

GAAR (General Anti-Avoidance Rule)

Sections 95-102 outline GAAR provisions, which target impermissible tax avoidance structures.

These complex provisions are best handled with the expertise of firms like JD Shah Associates, who specialize in international and cross-border tax matters.

Compliance Requirements

PAN Requirements

Mandatory for specified transactions. In absence of a PAN, TDS at higher rates (20%) is applicable under Section 206AA.

Equalization Levy

A 6% levy on specified digital services and 2% on e-commerce transactions offered by non-residents in India.

Significant Economic Presence (SEP)

Introduced to tax digital transactions where physical presence is not necessary but economic activity is significant.

Advance Filing Requirements

Advance Tax Obligations

Non-residents must pay advance tax in four instalments if liability exceeds ₹10,000:

- 15% by June 15

- 45% by September 15

- 75% by December 15

- 100% by March 15

Interest Liability

Interest under Sections 234A, 234B, and 234C applies to delays in filing, non-payment, or deferment of advance tax.

Professionals can help you strategize tax payments through timely ITR Filing, especially where multiple jurisdictions are involved.

Conclusion

Taxation for non-residents under Indian law is highly technical, governed by intricate residency rules, income classification standards, DTAA frameworks, and procedural compliance.

Whether it’s understanding TDS implications or claiming treaty relief, non-residents must adopt a proactive approach to stay compliant and avoid penalties. With high-value transactions, digital footprints, and multi-source income becoming the norm, seeking professional guidance is no longer optional—it’s essential.

Plan early and stay compliant—reach out to expert Chartered Accountants today to simplify your global tax filing obligations and make the most of your eligible benefits.

![]()